Sustainable finance developments

- Articles and memoranda

- Posted 10.07.2023

During the first semester of 2023, several pieces of legislation and other guidance documents related to sustainable finance in the asset management industry have been published by national and European authorities.

Amongst these are:

- the European Commission's June 2023 sustainable finance package;

- the EU Commission FAQ on the interpretation and implementation of Taxonomy Regulation and SFDR;

- the European Supervisory Authorities ("ESAs")' consolidated Q&A on the SFDR and the SFDR RTS;

- the ESAs' consultation on the review of the SFDR RTS;

- the RTS on nuclear energy and fossil gas investment disclosures under SFDR;

- the CSSF update of its FAQ on SFDR;

- the CSSF SFDR data collection exercises;

- the CSSF's supervisory priorities in the area of sustainable finance;

- the new ESMA Guidelines on MiFID II suitability requirements; and

- the ESMA's final report on the new MiFID II Guidelines on product governance rule.

Each of these documents are detailed below.

1. New sustainable finance package

On 13 June 2023, the EU Commission published a new sustainable finance package with the aim of further strengthening the EU sustainable finance framework and ensuring that it continues to support companies and the financial sector, while encouraging the private funding of transition project and technologies.

The package is composed as follows:

1.1 Proposal for a regulation on ESG rating providers

The EU Commission is proposing a regulation to improve the reliability and transparency of ESG rating providers ("ESG Rating Providers Regulation").

Given the asset management industry's current widespread reliance on ESG data and ESG scores provided by unregulated ESG data providers when devising ESG methodologies for financial products, this proposal aims at improving the quality and reliability of ESG data.

The proposed ESG Rating Providers Regulation lays down requirements for authorisation for EU established ESG rating providers and an equivalence decision and process for non-EU ESG rating providers, organisational principles and clear rules on the prevention of conflicts of interest as well as requirements designed to ensure the quality and reliability of ESG rating providers' services to protect investors and market integrity.

Who is in scope?

The proposal applies to ESG rating providers which offer and distribute ESG ratings in the EU on a professional basis. Exemptions are provided and they notably include in-house ratings and raw ESG data without ratings or scores.

The term "ESG rating" is defined in a broad manner and encompasses, amongst others, an opinion, a score or a combination of both regarding an entity or financial product's ESG profile or characteristics provided to third parties and irrespective of its labelling.

What are the next steps?

The proposal will now be submitted to the EU Parliament and the Council which must agree on the text in order for it to become EU law.

The text, if and once adopted, will apply six months after its entry into force. Transitional provisions are provided for ESG rating providers which provided their services at the date of entry into force of the ESG Rating Providers Regulation.

1.2 Taxonomy Non-Climate Delegated Act

Also on 13 June 2023, the EU Commission adopted the Taxonomy Non-Climate Delegated Act which:

introduces a new set of technical criteria in respect of the four remaining environmental objectives which are provided for in the Taxonomy Regulation and which started to apply on 1 January 2023, namely:

the sustainable use and protection of water and marine resources;

the transition to a circular economy;

the pollution prevention and control; and

the protection and restoration of biodiversity and ecosystems.

amends the Taxonomy Delegated Regulation (EU) 2021/2178 (i.e. transparency in non-financial statements) to ensure that the disclosure requirements laid down in it are consistent with the provisions of the proposal.

1.3 Amendments to the Taxonomy Climate Delegated Act 2021/2139/EU

In addition, the EU Commission adopted a set of amendments to the Taxonomy Climate Delegated Act 2021/2139/EU, which expand on economic activities contributing to climate change mitigation and adaptation not included so far, such as the manufacturing and transport sectors ("Amending Climate Delegated Act").

As regards the application timeline, the Taxonomy Non-Climate Delegated Act and the Amending Climate Delegated Act will be notified to the EU Parliament and the Council and they will enter into force at the end of a four-month period, if no objection is expressed by the EU Parliament and/or the Council (or before, if they inform the Commission that they will not object).

The application date provided for in the two delegated acts is 1 January 2024.

1.4 Recommendation on transition finance

The Commission published a recommendation on transition finance ("Recommendation on transition finance"). A recommendation is a non-binding EU Act and its objective is generally to provide guidance. In this case, the Recommendation on transition finance also gives practical examples for companies and the financial sector, with the aim to support market participants that wish to obtain or provide transition finance by offering practical suggestions on how to approach transition finance.

The text is addressed to:

(i) undertakings that want to contribute to the transition to climate neutrality and environmental sustainability, while enhancing their competitiveness and are seeking finance for investments for this purpose;

(ii) financial intermediaries and investors that are willing to provide transition finance to undertakings; and

(iii) Member States and financial supervisory authorities, to raise awareness of the topic and provide technical assistance, to encourage the uptake and provision of transition finance to the real economy.

The recommendation is generally not intended to apply to micro enterprises, i.e. companies which employ fewer than 10 persons and the annual turnover and/or annual balance sheet total of which does not exceed EUR 2 million, given their size and administrative capacity.

2. EU Commission FAQ on the interpretation and implementation of Taxonomy Regulation and SFDR

On 12 June 2023, the EU Commission published an FAQ on the interpretation and implementation of Taxonomy Regulation and SFDR. In particular, the FAQ provides clarifications on how the operators should consider the requirements for compliance with minimum safeguards under the Article 18 of Taxonomy Regulation. Importantly, it also confirms that the Taxonomy-aligned investments qualify as 'sustainable investments' under the SFDR.

3. ESAs' consolidated Q&A on the SFDR and the SFDR RTS

On 17 May 2023, the ESAs published a consolidated Q&A on SFDR which combines (i) the responses given by the EU Commission to questions requiring the interpretation of Union Law and (ii) the responses of the ESAs relating to the practical application or implementation of SFDR (JC 2023 18).

Below, we set out the key points of the last Commission responses (dated April 2023).

3.1 Definition of "sustainable investments"

The Commission helpfully clarifies that the definition of "sustainable investment" pursuant to Article 2 (17) SFDR does "not prescribe any specific approach to determine the contribution of an investment to environmental or social objectives. Financial market participants must disclose the methodology they have applied to carry out their assessment of sustainable investments […]." Moreover, as regards the reference to "economic activities" in Article 2 (17) SFDR, the Commission made it clear that, under Article 2 (17) SFDR, financial products (such as Undertaking for Collective Investment in Transferable Securities ("UCITS") and Alternative Investment Funds ("AIFs")) can make investments that do not specify the use of proceeds, such as investments in the general equity or debt of investee companies and that the "notion of sustainable investment can therefore also be measured at the level of a company and not only at the level of a specific activity".

Regarding the question how the "contribution" of an economic activity to an environmental or social objective should be measured, the Commission responded that "SFDR does not set out minimum requirements that qualify concepts such as contribution, do no significant harm, or good governance, i.e. the key parameters of a 'sustainable investment'. Financial market participants must carry out their own assessment for each investment and disclose their underlying assumptions. This policy choice gives financial market participants an increased responsibility towards the investment community and means that they should exercise caution when measuring the key parameters of a 'sustainable investment'".

The above answers from the Commission provide, for the time being, helpful certainty to the industry as they make it clear that there are no minimum requirements to determine a sustainable investment under Article 2 (17) SFDR and more particularly that no minimum revenue threshold, in respect of investee companies' revenues linked to sustainable activities, needs to be applied in order for an entire investment to be considered sustainable but that Financial Market Participant ("FMPs") must make their own assessment and disclose the methodology used to carry out that assessment. The Commission does however remind FMPs that this increased responsibility towards the investment community means that caution should be exercised when measuring the key parameters of a sustainable investment.

According to the Commission, relying on a transition plan aimed at ensuring that the investment will not significantly harm any environmental or social objective in the future would not be sufficient in order to qualify the investment as sustainable.

3.2 Article 9 (3) SFDR – objective of carbon emissions reduction

The Commission clarifies that Article 9 (3) SFDR is "neutral in terms of product design" and that financial products with a carbon emissions reduction objective can fall in its scope whether they are actively or passively managed.

In addition, the Commission helpfully recalls that SFDR is a transparency regulation and that SFDR does not prescribe the use of a Paris-aligned Benchmark nor a Climate Transition Benchmark but were none is passively tracked then a detailed explanation is required on how the continued effort of attaining the carbon emissions reduction can be ensured.

The Commission also confirms our understanding that funds that passively track a Paris-aligned Benchmark or a Climate Transition Benchmark are deemed to have sustainable investments and are not required to comply with the second paragraph of Article 9 (3) SFDR, i.e. they are not required to disclose a detailed explanation of how the continued effort of attaining the objective of reducing carbon emissions is ensured in view of achieving the long-term global warming objectives of the Paris Agreement.

3.3 Article 8 SFDR – promotion of carbon emissions reduction

The Commission also makes it clear that Article 8 SFDR funds are able to promote carbon emissions reductions as part of their promoted environmental characteristics without falling within Article 9 (3) SFDR, provided that investors are not mislead in believing that this aspect is part of the fund's objective and therefore that the fund has a sustainable investment objective pursuant to Article 9 (3) SFDR.

3.4 The "consideration" of PAIs

The Commission provides guidance on the meaning of the "consideration" of Principal Adverse Impacts ("PAIs") pursuant to Article 7 (1) SFDR ("…a clear and reasoned explanation of whether, and, if so, how a financial product considers principal adverse impacts on sustainability factors") by stating that the description related to the adverse impacts should include both a description of the adverse impacts and the procedures put in place to mitigate them

4. ESAs' consultation on the review of the SFDR RTS

The ESAs are proposing changes to the disclosure framework in the SFDR RTS to address issues that have emerged since the introduction of the SFDR (Joint Consultation Paper on the Review of SFDR Delegated Regulation regarding PAI and financial product disclosures).

More specifically, the ESAs seek feedback on the following amendments:

- extending the list of universal social indicators for the disclosure of the PAIs of investment decisions on the environment and society;

- refining the content of other PAIs and their respective definitions, applicable methodologies, calculation and the presentation of external information; and

- adding product disclosures regarding decarbonisation targets, the level of ambition and how the target will be achieved.

Moreover, the ESAs propose further technical revisions to the SFDR RTS by:

- improving the disclosures on how sustainable investments "do not significantly harm" the environment and society;

- simplifying pre-contractual and periodic disclosure templates for financial products; and

- making other technical adjustments concerning, among others, the treatment of derivatives, the definition of equivalent information, and provisions for financial products with underlying investment options.

In this respect, the ESAs published a consultation paper (which includes the draft Regulatory Technical Standards ("RTS") amending the SFDR RTS and the relevant annexes) together with an official reply form.

The consultation is open until 4 July 2023. The ESAs organised a joint public hearing and a targeted consumer testing during the consultation period

5. RTS on nuclear energy and fossil gas investment disclosures under SFDR

On 20 February 2023, the RTS on nuclear energy and fossil gas investment disclosures under SFDR, which amend the previous SFDR RTS, became applicable (Commission Delegated Regulation (EU) 2023/363) ("Amended SFDR RTS"). The Amended SFDR RTS introduced pre-contractual and periodic transparency requirements in relation to Taxonomy-aligned fossil gas and nuclear energy related activities for financial products disclosing under Articles 8 and 9 of SFDR.

In a Communiqué dated 8 March 2023, the CSSF provided some guidance to FMPs on the application of the Amended RTS.

5.1 Pre-contractual documents

FMPs must present the pre-contractual disclosure information in the format of the templates set out in the annexes of the Amended SFDR RTS for:

- UCITS/AIFs launched after 20 February 2023; and

- existing UCITS/AIFs for which changes are introduced in the prospectus/issuing document after 20 February 2023.

In the case where changes to the prospectus/issuing document are limited to the use of the new templates set out in the annexes to the Amended SFDR RTS, FMPs must confirm in the application file submitted to the CSSF (i) the use of new templates and (ii) that no other changes have been performed.

5.2 Periodic reports

For annual reports of UCITS/AIFs, issued after the entry into force of the Amended SFDR RTS and irrespective of the financial year-end of the UCITS/AIFs, FMPs must present the periodic disclosure information in the format of the templates set out in the annexes of the Amended SFDR RTS.

6. CSSF update of its FAQ on SFDR

On 13 March 2023, the CSSF updated its FAQ on SFDR by adding three new questions/answers which are summarised below:

6.1 Use of ESG and/or sustainability related terminology in fund names: Are there any ESG and/or sustainability related considerations that FMPs need to take into account in relation to fund names?

The CSSF refers to ESMA's supervisory briefing on sustainability risks and disclosures in the area of investment management and reminds FMPs that SFDR disclosures need to be easily accessible, simple, fair, clear and not misleading and that this also applies to fund names (irrespective of whether this is an Article 6, 8 or 9 SFDR fund). It follows that the CSSF expects that any use of Environmental, Social and Governance ("ESG") and/or sustainability-related terminology in funds names (e.g. green, ESG, ethical, impact etc.) is not misleading and aligned with the investment objective and policy.

In principle, this confirms existing CSSF practice when it comes to fund names and is not a new CSSF position as such. However, the evolution of the proposed ESMA guidelines on fund names will need to be watched closely in terms of further rules regarding the names of ESG funds.

6.2 Methodology used to define sustainable investments: Shall the methodology used to define sustainable investments be made available to investors?

On 5 May 2023, the CSSF removed this question and the answer it had given. Although it did not give an explanation for this removal, we can assume that this results from the publication of the EU Commission guidance (i.e. FAQ from the EU Commission with its responses to ESAs' SFDR interpretation questions published in April 2023), reproduced below, which states that the methodology for determining sustainable investments must be disclosed (the EU Commission guidance does not state where this must be disclosed, therefore, in our view, it can be made on a website).

"The definition of sustainable investment set out in Article 2, point (17), SFDR does not prescribe any specific approach to determine the contribution of an investment to environmental or social objectives. Financial market participants must disclose the methodology they have applied to carry out their assessment of sustainable investments, including how they have determined the contribution of the investments to environmental or social objectives, how investments do not cause significant harm to any environmental or social investment objective and how investee companies meet the 'good governance practices' requirement. This is reflected in Commission Delegated Regulation (EU) 2022/12881 which, for example, requires financial market participants to explain how the indicators for adverse impacts on sustainability factors have been taken into account when carrying out the 'do no significant harm' test of sustainable investments. […]"

6.3 Efficient portfolio management ("EPM") techniques: Can EPM techniques used for hedging purposes fall within the "remaining portion" of the investment portfolio of funds disclosing under Article 9 SFDR?

The EU Commission had confirmed in its first FAQ dated 14 July 2021 that an Article 9 SFDR fund may, next to sustainable investments, also include investments for certain specific purposes, such as investments or techniques used for hedging purposes or relating to cash as ancillary liquidity, provided that they are in line with the sustainable investment objective. The CSSF is of the view that when used for "hedging" purposes, EPM techniques fall within the non-sustainable "remaining portion" bucket of an Article 9 fund. The CSSF refers to CSSF Circular 08/356 (applicable to Part II UCIs and UCITS) which sets out that EPM techniques may be used for different purposes, including for the reduction of risk. The CSSF states in its FAQ that FMPs are "responsible for assessing the precise purpose of any use of EPM techniques and thus whether those could fall within the "remaining portion" of the investment portfolio when used in the context of funds disclosing under Article 9 SFDR".

While not totally clear, the CSSF appears to want to limit the use of EPM (which could include EPM techniques such as securities lending, repos and reverse repos) in the "remaining portion" bucket of Article 9 funds to "hedging" only (i.e. according to the CSSF the reduction of risk).

7. CSSF SFDR data collection exercises

7.1 CSSF data collection on SFDR (entity level)

In February 2023, the CSSF launched a first data collection exercise on SFDR-related regulatory requirements which mainly focuses on the collection of information regarding organisational arrangements of Investment Fund Managers ("IFMs") which qualify as FMPs and/or financial advisers under SFDR (CSSF Communiqué on the SFDR data collection).

The CSSF expects the organisational arrangements of IFMs to take due account of the integration of sustainability risks, notably in terms of human resources and governance, the investment decision or advice process, the remuneration and risk management policies and the management of conflicts of interest.

The deadline for submission of the report was 2 March 2023. However, the data collection exercise is ongoing insofar as FMPs and financial advisers must keep the report up to date. Therefore, in case of changes after the initial or a subsequent submission, an updated declaration must be submitted to the CSSF via a dedicated module on eDesk.

In the future, the CSSF data collection exercise will be extended to the information contained in the PAI statements (further details on the timing and process will be communicated by the CSSF at a later stage).

7.2 CSSF data collection on SFDR/Taxonomy Regulation (product level) - Extension of the initial submission deadline to 15 October 2023

At the end of March 2023, the CSSF launched a second SFDR data collection exercise this time focusing on the sustainability-related information that IFMs (including registered AIFMs) are required to include in the pre-contractual disclosures of financial products in accordance with SFDR, the Taxonomy Regulation and the SFDR RTS (CSSF Communiqué 24 March 2023).

Together with the Communiqué dated 24 March 2023, the CSSF published a user guide which provides clarifications on the content and the format of the information to be reported as well as technical details on the data collection process.

The requested information relates to the Article 6, 8 and 9 Luxembourg-domiciled UCITS/AIFs, including unregulated AIFs (unless they were closed before 1 January 2023) and the reporting exercise must be done at sub-fund level. The reporting must also be consistent with the information already contained in the pre-contractual disclosures.

The deadline for the submission of information was initially set for 15 June 2023, but in early May, the CSSF decided to give a little more time and extended the final deadline to 15 October 2023. However, the CSSF stresses that FMPs should still try to provide the relevant information on a best effort basis by 15 June 2023. The CSSF also reminds IFMs that they are responsible for keeping the document up to date. Therefore, in case of changes to the pre-contractual documents/templates, they must update the data previously reported (CSSF Communiqué 4 May 2023).

In the near future, the CSSF data collection exercise will be extended to the information contained in the PAI statements and in the periodic disclosure templates (further details on timing and practical proceeding of this extended data collection will be communicated by the CSSF at a later stage).

7.3 CSSF data collection on SFDR/Taxonomy Regulation

On 30 June 2023, the CSSF, launched a new phase of its SFDR data collection exercise, this time focusing on the disclosures in periodic reports for financial products disclosing under Article 8 or Article 9 of SFDR (CSSF Communiqué 30 June 2023).

This SFDR data collection exercise is applicable to the following FMPs.

- UCITS management companies, based in Luxembourg or in another EU Member State, in relation to all Luxembourg-domiciled UCITS they manage;

- Self-managed UCITS based in Luxembourg;

- Authorised AIFMs, based in Luxembourg in relation to all Luxembourg-domiciled regulated and unregulated AIFs (including ELTIFs) they manage;

- Authorised AIFMs, based in another EU Member State, in relation to all Luxembourg-domiciled regulated AIFs, as well as Luxembourg-domiciled unregulated AIFs (only when they qualify as ELTIFs) they manage;

- Registered AIFMs, subject to Article 3(3) of the AIFM Law, based in Luxembourg or in another EU Member State, in relation to all Luxembourg-domiciled regulated AIFs they manage;

- Internally managed AIFs based in Luxembourg;

- Institutions for occupational retirement provision ("IORPs"), subject to the Law of 13 July 2005.

It is mandatory for all (sub-)funds of a UCITS/AIF/IORP disclosing under Article 8 or 9 of SFDR.

The information relating to disclosures in periodic reports, included in the annual reports issued as from 1 January 2023 and with a financial year-end on or after 30 September 2022 must be provided to the CSSF according to the following deadlines:

- For periodic reports issued between 1 January 2023 and 31 December 2023: by 31 January 2024 at the latest.

- For periodic reports issued as from 1 January 2024: at the latest, one month after the legal deadline to publish the annual report or to make it available to investors.

Accordingly, the aforementioned information must be submitted to the CSSF, at the latest, 5 months after financial year-end for UCITS, respectively 7 months for AIFs and IORPs.

A user guide providing clarifications on the content and the format of the information to be reported as well as technical details on the data collection process are available under SFDR UCI periodic data collection – Practical and technical guidance.

In the near future, the CSSF data collection exercise will be extended to the information contained in the PAI statements (further details on timing and practical proceeding of this extended data collection will be communicated by the CSSF at a later stage).

8. CSSF's supervisory priorities in the area of sustainable finance

In April 2023, the CSSF published a general overview of its supervisory priorities in the area of sustainable finance. The objective was to draw the attention of the financial sector to a number of important matters to be addressed in this area (CSSF Communiqué 6 April 2023).

The key points of attention of the CSSF for each type of supervised entities are listed in the CSSF Communiqué, i.e.:

- supervisory priorities for the asset management industry;

- supervisory priorities for the credit institutions;

- supervisory priorities for investment firms; and

- supervisory priorities for issuers.

As regards the asset management industry, the CSSF will focus on the following priority areas in accordance with a risk-based approach:

- a) organisational arrangements of IFMs, including the integration of sustainability risks by FMPs;

- b) verification of the compliance of pre-contractual and periodic disclosures;

- c) verification of the consistency of information in fund documentation and marketing material;

- d) verification of the compliance of product website disclosures; and

- e) portfolio analysis (in this respect, the CSSF will undertake supervisory actions to ensure that portfolio holdings reflect the name, the investment objective, the strategy, and the characteristic displayed in the documentation to investors).

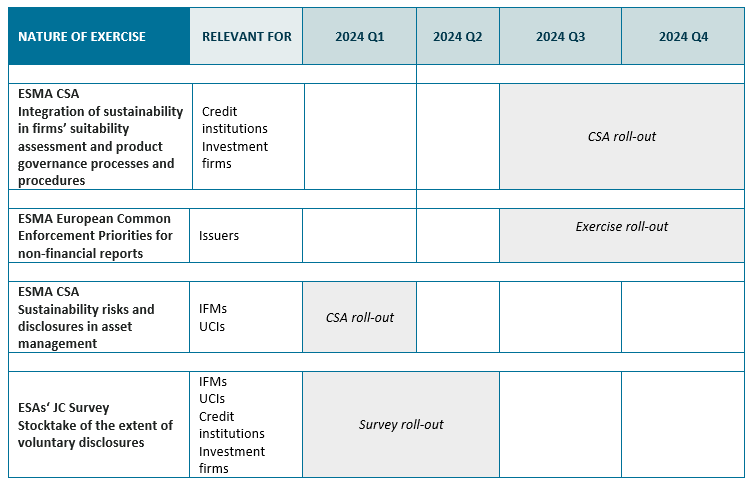

In the same publication, the CSSF also recalls its role in the context of international cooperation in sustainable finance and provides an overview of supervision exercises in the area of sustainable finance, as planned by the ESAs:

9. MiFID II suitability requirements: ESMA Guidelines

On 16 May 2023, the CSSF published Circular 23/835 to inform the industry of the application of the ESMA guidelines on certain aspects of the MiFID II suitability requirements (ESMA35-43-3172) ("Guidelines") as from 3 October 2023.

The Guidelines apply to investment firms and credit institutions which provide the investment service of investment advice and portfolio management and also to UCITS ManCos and AIFMs which have a MiFID top-up license to provide those investment services.

The Guidelines integrate the recent changes made in the MiFID II delegated acts and amends the current Guidelines on the following points:

- the integration of sustainability factors, risk and preferences into organisational requirements and operating conditions for investment firms;

- the good and poor practices identified in ESMA's 2020 Common Supervisory Action (CSA) on suitability;

- the amendments introduced through the Capital Markets Recovery Package to Article 25 (2) of MiFID II.

Some of the key changes brought to the previous version of the Guidelines (i.e. the 2018 ESMA guidelines) on the topic of sustainability are the following:

- information to clients: firms will need to explain to their clients the different elements of the definition of sustainability preferences and explain the difference between investment products with and without sustainability features in a clear manner, avoiding technical language;

- collection of information on clients' sustainability preferences: the information will need to include all aspects mentioned in the definition of sustainability preferences and will need to be sufficiently granular to allow for a matching of the client's sustainability preferences with the sustainability-related features of financial instruments;

- assessment of sustainability preferences: once the firm has identified a range of suitable products for client, the firm will need to identify the product(s) that fulfil the client's sustainability preferences; and

- organisational requirements : firms will need to give staff appropriate training on sustainability topics and keep appropriate records of the sustainability preferences of the client (if any) and of any updates of these preferences.

The previous ESMA guidelines issued on this topic (i.e. ESMA35-43-1163) will cease to apply on 3 October 2023.

9. MiFID II product governance rules: Integration of sustainability factors

On 27 March 2023, ESMA published its final report on the new set of guidelines on MiFID II product governance requirements (ESMA35-43-3448).

The new product governance Guidelines ("New Product Governance Guidelines") will apply to MiFID firms and UCITS ManCos/AIFMs which have a MiFID top-up license.

The New Product Governance Guidelines specify the obligations applying as regards the integration of sustainability factors into the product governance obligations. They also take into account the following recent regulatory and supervisory developments:

- the Commission's Capital Markets Recovery Package and subsequent work on the review of MiFID II;

- the recommendations on the product governance guidelines by ESMA's Advisory Committee on Proportionality ("ACP"); and

- the findings of ESMA's 2021 CSA on product governance (ESMA35-43-3137).

The Guidelines will not be further amended; the only remaining step is their translation into the EU languages. They will apply two months after the publication of these translations on ESMA's website.

-

REGULATION (EU) 2020/852 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088

- europa.eu

-

Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (Text with EEA relevance)

- europa.eu

-

COMMISSION DELEGATED REGULATION (EU) 2022/1288 of 6 April 2022 supplementing Regulation (EU) 2019/2088 of the European Parliament and of the Council with regard to regulatory technical standards

- europa.eu

-

Sustainable finance package

- ec.europa

-

Consolidated questions and answers (Q&A) on the SFDR (Regulation (EU) 2019/2088) and the SFDR Delegated Regulation (Commission Delegated Regulation (EU) 2022/1288)

- esma.europa

-

Joint Consultation Paper on the Review of SFDR Delegated Regulation regarding PAI and financial product disclosures

- esma.europa

-

Joint Consultation Paper on the Review of SFDR Delegated Regulation regarding PAI and financial product disclosures

- esma.europa

-

Joint Consultation Paper on the review of SFDR Delegated Regulation regarding PAI and financial product disclosures - Reply form

- esma.europa

-

Commission Delegated Regulation (EU) 2023/363 of 31 October 2022 amending and correcting the regulatory technical standards laid down in Delegated Regulation (EU) 2022/1288 as regards the content and presentation of information

- europa.eu

-

Communication to the investment fund industry on the entry into force of the Commission Delegated Regulation (EU) 2023/363 of 31 October 2022 amending and correcting the regulatory technical standards laid down in Delegated Regulation (EU) 2022/1288

- cssf.lu

-

CSSF FAQ Sustainable Finance Disclosure Regulation (SFDR)

- cssf.lu

-

SFDR data collection exercise for investment fund managers (IFMs) on regulatory requirements in relation to Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector (SFDR)

- cssf.lu

-

SFDR data collection exercise applicable to investment fund managers (IFMs) and institutions for occupational retirement provision (IORPs) on precontractual disclosures

- cssf.lu

-

SFDR UCI precontractual data collection – practical and technical guidance

- cssf.lu

-

Extension of the initial submission deadline for the SFDR data collection exercise on precontractual disclosures

- cssf.lu

-

SFDR data collection exercise applicable to investment fund managers (IFMs) and institutions for occupational retirement provision (IORPs) on periodic disclosures

- cssf.lu

-

Law of 12 July 2013 on alternative investment fund managers

- cssf.lu

-

Law of 13 July 2005 on institutions for occupational retirement provision in the form of pension savings companies with variable capital (SEPCAVs) and pension savings associations (ASSEPs)

- cssf.lu

-

SFDR UCI periodic data collection – Practical and technical guidance

- cssf.lu

-

The CSSF’s supervisory priorities in the area of sustainable finance

- cssf.lu

-

Guidelines on certain aspects of the MiFID II suitability requirements

- esma.europa

-

ESMA presents the results of the 2020 Common Supervisory Action (CSA) on MiFID II suitability requirements

- esma.europa

-

DIRECTIVE (EU) 2021/338 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 February 2021 amending Directive 2014/65/EU as regards information requirements, product governance and position limits, and Directives 2013/36/EU and (EU) 2019/878

- europa.eu

-

Final Report Guidelines on certain aspects of the MiFID II suitability requirements

- esma.europa

-

Guidelines on certain aspects of the MiFID II suitability requirements

- esma.europa

-

Final report Guidelines on MiFID II product governance requirements

- esma.europa

-

Coronavirus response: How the capital markets union can support Europe’s recovery

- ec.europa

-

PUBLIC STATEMENT ESMA presents the results of the 2021 Common Supervisory Action (CSA) on MiFID II product governance requirements

- esma.europa